Wolters Kluwer’s cloud-based solution CCH Integrator simplifies tax compliance and reporting, enhancing control, minimising risk, and providing greater accuracy and alignment across the tax function globally. CCH Integrator is a cost-effective way for tax teams to adopt an award-winning solution built for tax.

Cloud-based tax management solutions

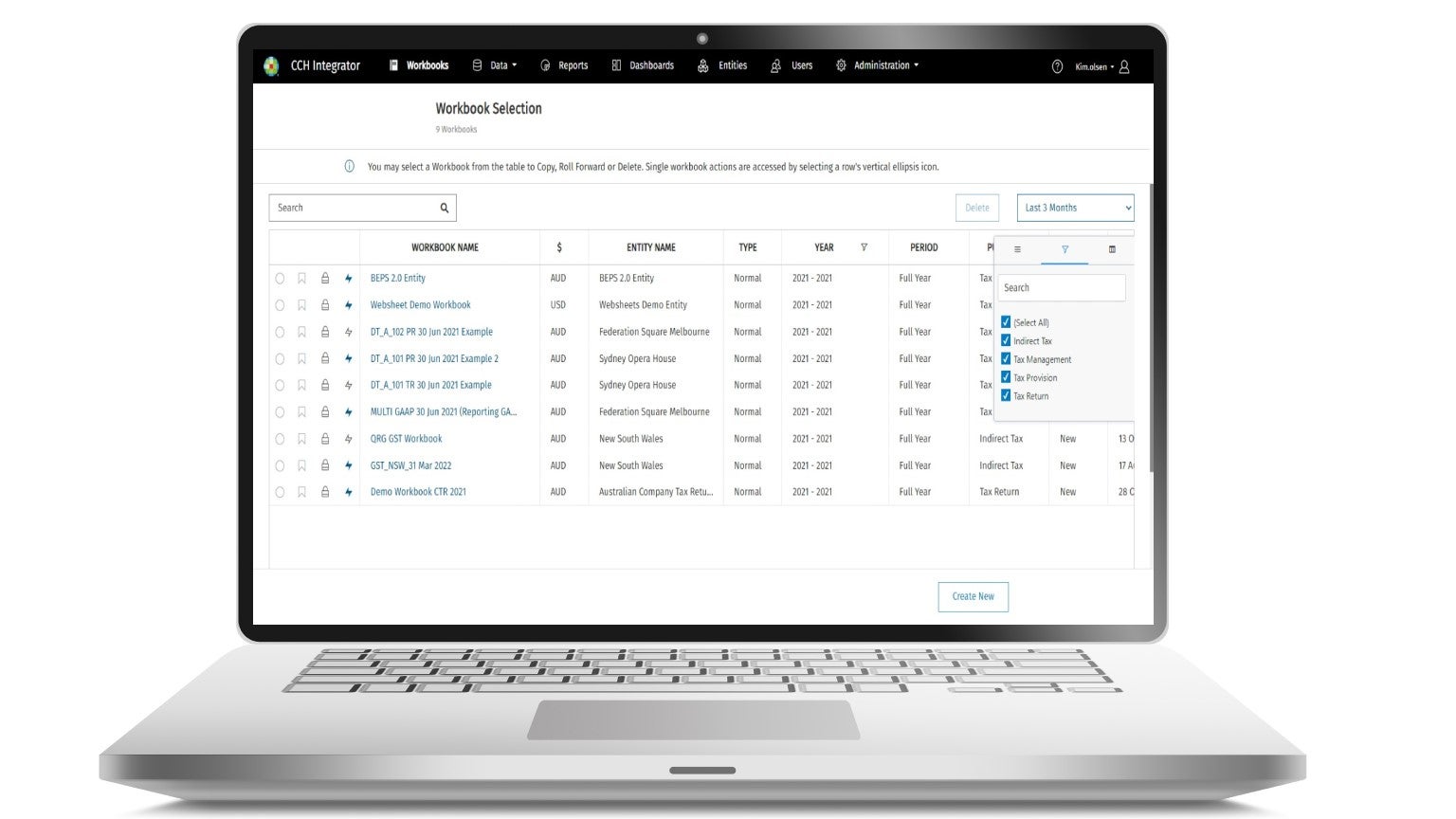

Although taxes are a necessary part of any business, tax laws are constantly changing and evolving, which can make things challenging for businesses, especially when they are required to comply with different tax regulations across multiple countries. Wolters Kluwer’s CCH Integrator takes a modular approach to finance, enabling teams within the tax department to choose a best-in-category technology most suitable to their teams needs. It is comprised of six core modules: Direct Tax, Indirect Tax, International Tax, Employment Taxes, Country-by-country (CbCR), and BEPS Pillar Two. CCH Integrator supports tax teams by helping them to increase their control, reduce risks, and make their processes more efficient.

CCH Integrator serves as the ultimate authority in overseeing and managing tax controls within tax governance and control frameworks. Beyond this pivotal role, it offers a range of functionalities designed to enhance an organisation’s tax management processes. By providing a unified platform, CCH Integrator enables users to carry out enterprise-wide self-assessments of their organisations’ tax maturity, fostering collaboration between tax, finance, internal audit, risk/governance, and technology teams. This integrated approach enables the efficient identification of gaps and supports the development of remediation plans. In addition, CCH Integrator empowers upstream compliance and stakeholder reporting, ensuring seamless communication and alignment across an organisation’s tax functions.

Modern tax departments use CCH Integrator to shift from traditional Excel-based methods to a more efficient tax management platform. Unlike Excel, CCH Integrator offers a dynamic and collaborative platform that streamlines tax processes, enhances accuracy, and saves time. Its real-time data consolidation, validation, and reporting capabilities eliminate manual tasks, increasing efficiency. Being cloud-based, it facilitates global collaboration, ensuring stakeholders can work together on a single source of data. This not only strengthens workflow efficiency but also reduces risks related to version control problems in Excel.

A key benefit of CCH Integrator is its use of low code technology, enabling rapid adaptation to evolving regulations and organisational needs. With a user base of over 15,000 individuals across 80 countries, including the Top 10 Financial Institutions in Australia and all Big 4 professional services firms, CCH Integrator is a proven and globally trusted solution for tax management.

Tax compliance, country-by-country reporting, and BEPS Pillar Two

CCH Integrator and the BEPS Pillar Two solution provide a single, scalable workspace to allow tax professionals to streamline the tax reporting and compliance processes, using inbuilt automation to keep up with the changing tax landscape. As a tax engine integrating end-to-end reporting and compliance processes, it leverages tax provision and CbCR modules to streamline data collection and reporting processes for tax departments.

The BEPS Pillar Two solution takes a ‘bottom-up’ approach that is in line with the OECD guidance, and a ‘top-down’ approach that specifically caters to data gathering, calculations, reporting, and Pillar Two governance for the Tax Department. The BEPS Pillar Two solution gives tax teams the ability to calculate and report on qualified domestic minimum top-up tax (QDMTT), helping them to determine whether they do or do not need to pay top-up tax.

CCH Integrator already collects financial statement information as part of its tax provision process and holds effective tax rate breakdowns, which can feed into the Pillar Two rule tracker. Its tax provisioning module also follows IFRS/IAS12 to easily accommodate income tax and its impact on BEPS Pillar Two top-up tax. BEPS Pillar Two is also easily integrated into the tax provisioning reporting process of CCH Integrator. As an alternative, the CCH Integrator BEPS Pillar Two module can be adopted and used as a standalone module.

CCH Integrator maintains the lodgment forms for each applicable country for BEPS Pillar Two. This helps users to ensure that their companies are accurately and consistently capturing all of the required information according to national and international BEPS Pillar Two rules. The solution is flexible and able to adapt in real time to global OECD Rules and local domestic minimum tax filing requirements.

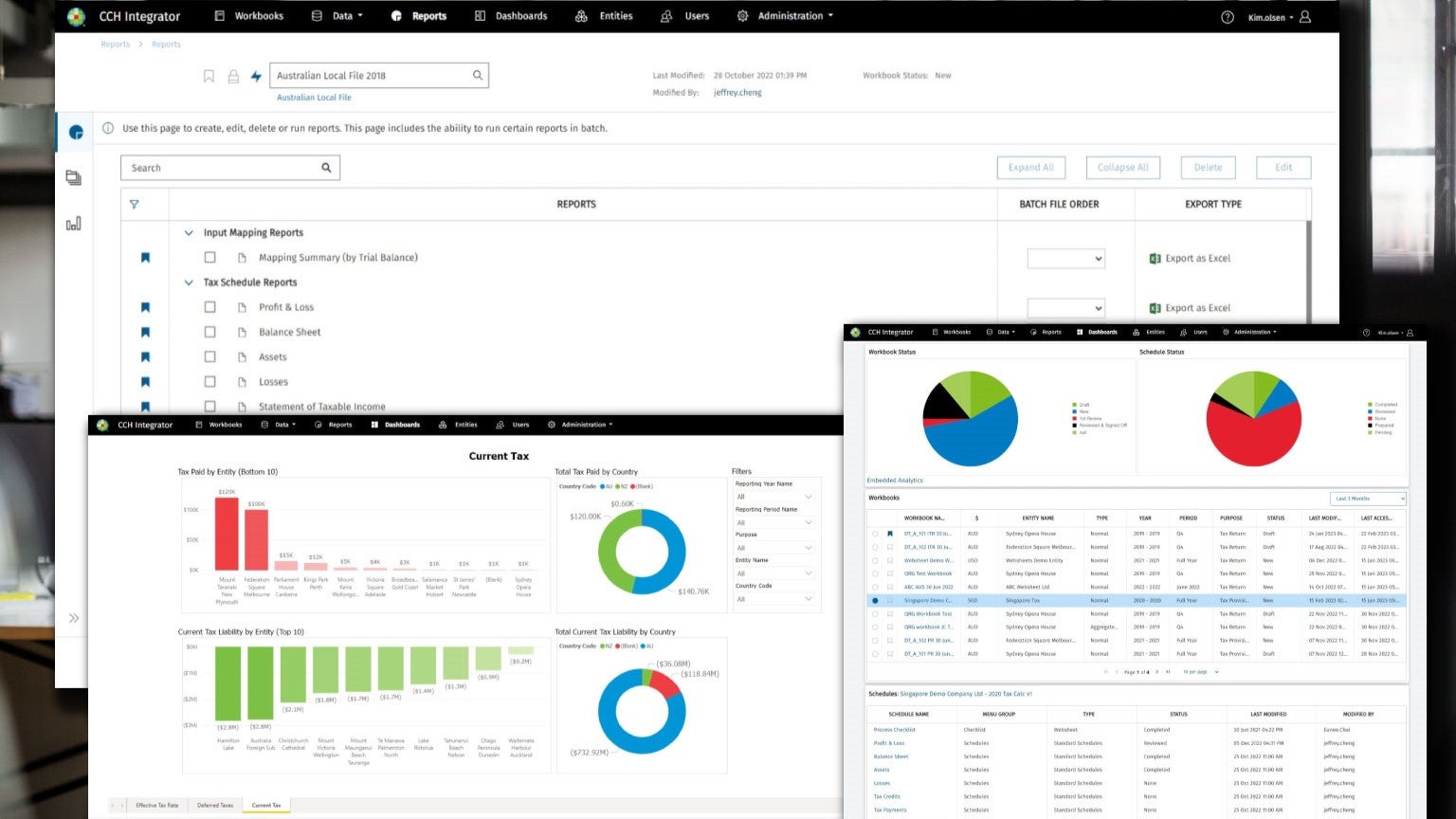

CCH Integrator facilitates configurable workpaper templates to standardise tax reporting and help users to adapt to specific local needs. In addition, the platform can perform multiple consolidations, including currency conversion, at both local and group levels, with a multi-language enabled interface that can be used anywhere in the world. It offers one complete platform for all types of corporate tax reporting and compliance, not just Pillar Two.

Tax reporting and calculations

CCH Integrator provides tax teams with a modern tax provisioning solution that simplifies direct tax reporting across multiple jurisdictions. This helps users to quickly and confidently calculate corporate tax provisions for financial close deadlines using consistent tax calculations.

CCH Integrator offers comprehensive reporting capabilities tailored for Group Tax Reporting, consolidating both reporting and local GAAP requirements within a single platform. By automating data collection and tax rules, the system can enhance timeliness and accuracy, facilitating faster reporting for financial close processes. Configurable workpapers enable compliance with various tax regimes while granular control and permissions enhance team collaboration and oversight. Integration with existing ERP and finance applications helps to streamline workflows while data reuse reduces rework in corporate income tax compliance processes. CCH Integrator optimises efficiency, accuracy, and compliance across tax reporting workflows.

Tax data management

CCH Integrator is known for its strong tax data management capabilities, offering businesses flexibility in capturing both structured and unstructured data to ensure comprehensive data coverage. By automatically feeding data into tax calculations, it maintains a singular source of information, guaranteeing accuracy and consistency across all reports. Its seamless integration with Business Intelligence (BI) solutions enhances data analysis and enables users to make informed decisions. Leveraging the extensive scale and expertise of Wolters Kluwer, CCH Integrator delivers reliable and up-to-date tax management solutions, empowering businesses with compliance, efficiency, and insights for optimised performance.

About Wolters Kluwer

Wolters Kluwer drives global commerce by enabling tax and accounting professionals and businesses of all sizes to drive productivity, navigate change, and deliver better outcomes. Using workflows optimised by technology and guided by extensive domain expertise, the company helps organisations to grow, manage, and protect their businesses and their client’s businesses.

Reach out to the CCH Integrator team to explore how we can help transform your tax practice. Click here to request a demonstration.