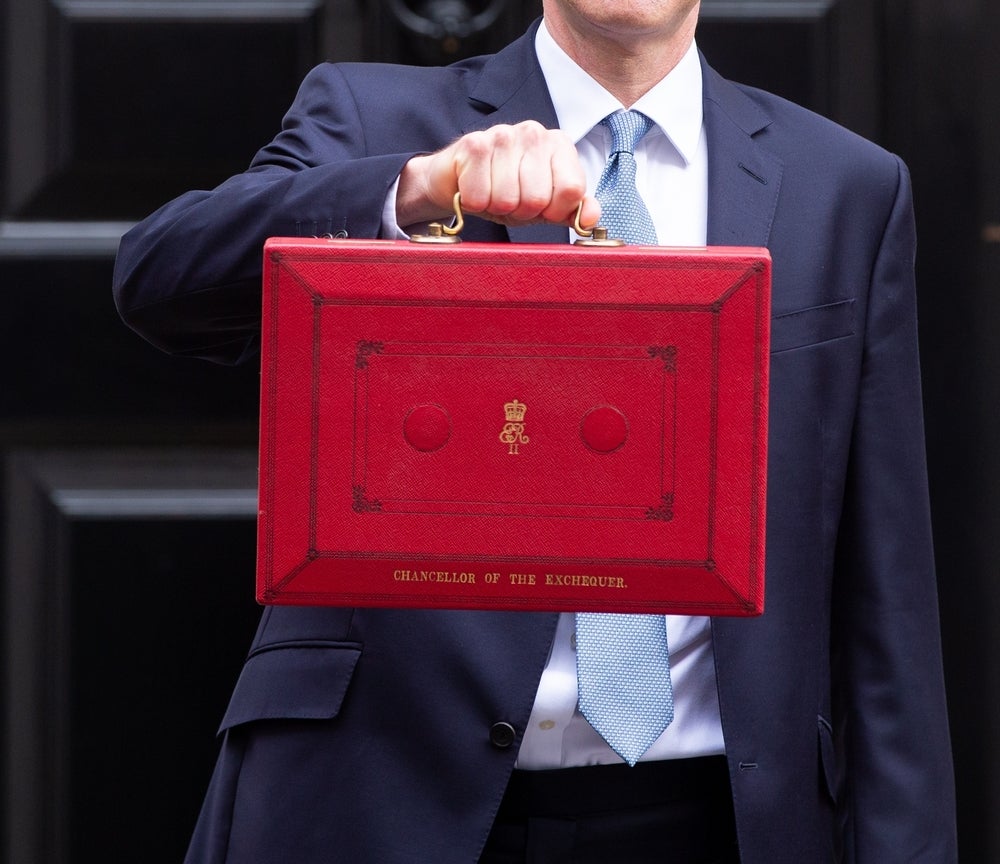

Jeremy Hunt, Chancellor of the Exchequer for the UK, has delivered his Spring Budget, more than likely the last budget before a general election. What is the financial services sector reaction? We ask the experts.

Sirsha Haldar, General Manager of ADP UK, Ireland, & South Africa

The workforce eagerly anticipates initiatives addressing critical concerns such as skills shortages and training. Businesses require government support to prioritise flexible training programmes that address skills deficits and drive innovation. Such investments are essential to propel the economy forward and we need to ensure that skills development takes center stage on our economic agenda as we progress.

Mark Ashbridge, Managing Director, Ashbridge Partners

We are supportive of the Chancellor’s decision to reduce national insurance by 2% as a means of stimulating activity in the economy and improving the UK’s productivity. However, we also recognise that the Chancellor has limited fiscal headroom for manoeuvre and as such there is a limit to what he can do.

The impact of the Spring Budget on the finance market is likely to be limited on people’s cost of borrowing and will not materially change the prospect for inflation and ultimately interest rates. Since the New Year we have seen residential mortgage rates fall below 4.00% although more recently they have edged up in response to rising SWAP rates. However, we expect that the next quarter will bring a return to the sub 4.00% rates as inflation falls and central banks become more confident that they have inflation under control.

Our own interactions with clients and their businesses illustrate how they are more cautionary on spending, reducing costs where possible and feeling the impact of higher energy and mortgage costs as contracts and mortgages are renewed. For example, 1.5 million households are coming off historically low fixed rates this year and will see their annual interest costs double in many cases.

Fiona Fernie, Partner, Private Client, Blick Rothenberg

The abolishment of the non-dom regime will (after the transitional period) simplify the tax system for non-UK nationals coming to the UK which is obviously welcome. However, the four-year period of ‘exemption’ may be significantly short that those that we want to attract to the UK do not become integrated into UK life to a point which prevents them leaving as soon as the exemption period is over.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPaul Haywood-Schiefer, Senior Manager Private Client, Blick Rothenberg

The Chancellor’s reforms on non-doms are welcome but what will the uptake be here. Most non-doms have the ability to move country and manage their time in the UK to be non-resident. Furthermore, when it comes to actual tax benefits from the regime, many are more worried about Inheritance Tax in the UK than income and capital gains tax rates. Therefore, with no change there, will we see a significant number leave the UK before the new rules come into effect, tempering the £15bn expected to be raised?

Sean Randall, Stamp Duty Partner, Blick Rothenberg

The government has chosen to abolish a Stamp Duty Relief that incentivises investment in the public rented sector (PRS). The relief can reduce the Stamp Duty Rate for relevant purchases to as low as 1%. Although the relief has undoubtedly helped investment in the PRS, it has also encouraged claims being made in respect of family homes with annexes – worth up to £88,750 of tax relief for a single annexe.

The extent to which the relief was (and continues to be) claimed on annexes has probably driven the decision to abolish it altogether. The Stamp Duty reclaim farms that have built their business around this activity will need to switch to something else. Property companies and institutional investors in PRS will surely be angry that the Government has ‘thrown the baby out with the bathwater’ rather than tackling abuse or unfairness head on.

Robert Salter, Director, Global Mobility, Blick Rothenberg

Whilst one or two aspects of Mr Hunt’s proposed changes to the non-domiciled basis of taxation should be welcome and will encourage those foreign nationals in the UK who are eligible to bring funds into the UK, a regime which only allows tax relief for 4 years – down from the present 15 years – is unlikely to proof popular to many international taxpayers.

In this regard, it is worth noting that many alternative regimes in other countries provide relief for 10 or 15 years (e.g. in Italy). Moreover, it is also worth noting that given the move to flexible working during Covid, it is increasingly easy for many international executives to work on a cross-border basis – that is, to live with their families in countries like Switzerland, Italy or France, whilst only spending say 2-3 days per week in the UK.

These cross-border commuters typically become ‘non-resident’ in the UK for tax purposes with the consequence that the UK tax take is restricted purely to their UK source income (e.g. the wages associated with UK workdays). Unfortunately, it is quite possible – indeed probable – that Mr Hunt’s announcement on the non-domiciled regime will simply increase the frequency of such arrangements in the coming years.

The Government’s proposed changes to the Child Benefit Clawback, meaning that for the 2024/25 tax year, it will not impact any household where no partner earns under £60,000 per annum (compared to the present £50,000 threshold) is to be welcomed.

However, whilst the Government’s move will reduce some of the unfairness that the present system creates, it certainly doesn’t eliminate the problem. As such, it would have been much fairer and simpler for the Government to recognise all the flaws of the child benefit clawback and simply remove the charge in totality.

Nimesh Shah, Chief Executive Officer, Blick Rothenberg

The changes to the non-dom regime are significant with a number of transitional provisions. Non-resident trusts will cease to be effective from 6 April 2025.

Non-doms having to revalue assets at 5 April 2019 is going to be hugely complicated and frustrating. Who will have the records to apply this in practice?

Ryta Zasiekina, founder & Co-CEO, Concryt

In response to Jeremy Hunt’s assertion that the UK is on track to become the world’s next Silicon Valley, it’s crucial to acknowledge the vibrancy of the fintech industry in the UK. While Hunt’s ambitions to attract more investment are commendable, the reality on the ground reveals a different picture.

Despite the availability of early-stage funding, scaling up remains a challenge for tech start-ups in Britain, often prompting them to seek investment from the US and even relocate their businesses. This trend underscores the need for more comprehensive support and resources to foster growth and innovation within the UK’s own investment ecosystem, ensuring that promising ventures can thrive and contribute to the country’s economic prosperity.

Rich Arundel, Chief Evangelist for Currencycloud and Visa Cross-Border Solutions

Unlocking investment for the best and brightest in UK technology can only be seen as a good thing. Making it easier for capital to flow into these businesses will have the triple benefit of helping home-grown success stories to thrive, making the UK a more attractive place to build and list innovative, high-growth firms, whilst also delivering better long-term returns for the UK’s savers. As a country, we have a rich history of innovation and entrepreneurship but the devil will be in the detail, and it is now a question of how the Chancellor plans to encourage this increased investment from pension funds.

Steve Watson, Director of Policy & Research, Cushon

We fully support the introduction of the “British ISA” specifically to allow savers to invest in UK plc. This move, in addition to the Mansion House Compact and new disclosure rules for Defined Contribution pensions, should both support the economy and encourage more people to save for the future.

However, the government must make sure that adding a new ISA does not add unnecessary complexity if it is to encourage take-up. The experience of the DC pensions sector shows us what damage inertia can do if savers are left baffled by the savings and investment landscape – an ISA allowance for UK shares will only succeed if savers feel engaged and empowered. We look forward to engaging on the full detail of these proposals.

It’s positive the Government is progressing plans to allow employees to move their pension when changing jobs, which not only stops multiple pots but also gives them a better sense of ownership over their pension which is lacking in the current set-up. Increased ownership should lead to engagement; engagement should lead to better savings outcomes. There is of course detail that needs to be worked through but it is a move that we support in principle and look forward to helping the Government shape. The policy will take time to develop and will depend on pension providers that have agile technology to deliver solutions that work for employers and employees alike, but if you step back and look at it from a customer perspective, it just makes sense.

Scott Dawson, Head of Sales and Strategic Partnerships, DECTA

Business leaders will certainly feel underwhelmed by the Chancellor’s UK Spring Budget announcements. They were unmistakably the product of an election year, coming from a party slipping ever-further behind in the polls – most recently with a 20-point deficit. The inevitable big populist handout came in the form of another cut to National Insurance contributions and a tax break for wealthy multiple homeowners.

What we needed were robust measures, tax relief and incentives that secure UK businesses prospects in the long term. The small gestures that were made barely promise to do this in the short term.”

The measures to raise the £85,000 VAT threshold is a small step in the right direction, but ‘too little, too late’ would be a massive understatement. A sweeping tax cut and more money in the general populations’ pockets would have been more what UK businesses needed to see for a much-needed surge in sales. Better yet, robust tax cuts that more directly benefit businesses with the economic climate as it stands hindering them from reaching their full potential. This might have been expected with politicians consistently describing business are the backbone of the economy. Equally, while getting rid of the non-dom status is a positive step, it’s only a partial solution and a more wholistic economic approach would be preferable.”

Elections polls have shown that that the majority of UK businesses now favour a Labour government and today’s announcements are unlikely to shift that balance significantly. UK businesses need to stop looking to a party with one foot out the door for answers and seriously examine if they have what it takes to survive a difficult economic period.

Nigel Green, CEO, deVere Group

Going into the Budget, we already knew that the Chancellor would announce a further cut to national insurance and extend a freeze on fuel and alcohol duty in a bid to ease the strain on people’s finances.

We knew this because it was announced in advance, presumably in an attempt to get as much mileage from the good news as possible with voters who go to the polls this year.

But the fact remains that the personal allowance – the amount people can earn before starting to pay tax – and the thresholds for the higher and additional rates – are frozen again. This means that as wages increase, more people will be pushed into higher-rate tax bands.

The tax burden in the UK is now to reach the highest levels in 70 years.

The Chancellor is dangling the carrot to potential voters by hinting at more tax cuts to come in the next Parliament – but only if the Conservatives win the general election this year.

Against this backdrop of increasing tax burdens, and an economy in a deeper-than-expected technical recession, meaning less investment for businesses and jobs, we expect that there will be a growing number of hard-working people across the country looking for work and life opportunities overseas.

Being squeezed harder in the UK, it can be reasonably assumed that they will be looking at destinations that offer lower tax liabilities, a lower cost of living, a growing economy, and more career, as well as lifestyle, opportunities.

The scrapping of the non-dom tax status is likely to be a ‘push factor’ from the UK, depriving the country of considerable direct and indirect investment as those affected are likely to simply move to more attractive jurisdictions.

In many ways the Chancellor’s Spring Budget was lacklustre.

It was a flop and that which could be a masterclass in the Law of Unintended Consequences as it could push more hard-working people and investors out of the UK.

Mauro De Santis Bo, GSB Wealth Partner

The abolishment of the non-domicile status will directly impact some of GSB’s clients, as we work with international families moving around the globe. Some of our clients are UK non-domicile and are currently living in the UK.

We personally have some non-doms living in the UK who will likely reconsider whether to remain residents after the recent changes. Our job is to explain the changes in the recent budget, how these will impact their current situation, and the options available.

Wealthy non-doms who have the right level of advice will most likely find different ways to mitigate the impact of the new residency-based system and remain UK residents, but some families will prefer to leave the country and seek a new home that offers better tax treatment.

It will be interesting to see how this new residency system will play with the current rules for Inheritance Tax. If no further clarity is given, this change could potentially lead to some inheritance tax headaches for those non-doms (which will now fall under the new ‘modern, simple and fairer residency-based system’) living in the UK.

Sarah Coles, head of personal finance, Hargreaves Lansdown

It’s the least surprising announcement in the Budget, and it’s nowhere near as far-reaching as an income tax cut, but the 2p National Insurance cut will make a real difference to how much people have in their pockets.

The more you earn, the more you save, so someone on a salary of £30,000 will save £349 a year, someone making £40,000 saves £549, someone on £50,000 saves £749, and anyone making over the higher rate tax threshold saves £754. These kinds of figures are not to be sniffed at, particularly for anyone being squeezed by higher mortgage payments or facing the multitude of price rises coming in Awful April.

Unfortunately, there’s no relief for those past state pension age – who don’t pay National Insurance – or those earning income from investments. It’s one reason why it makes sense to consider using your ISA allowances where you can, so you’re not relying on the generosity of a Chancellor with each passing budget.

But National Insurance is only one part of a wider tax picture, with is growing gloomier. This April we’ll see another freeze in the personal allowance and the higher rate tax threshold, which the OBR says will see 1.1 million more people dragged into paying income tax and 800,000 more forced to pay higher rate tax.

It means we can’t look at a National Insurance saving in isolation. We’re still locked into a freeze that means over time we’re going to see our tax bills continue to rise. And because more of the benefit of cuts goes to higher earners, those on lower earnings will suffer particularly. When you factor in both the National Insurance cut and the tax threshold freezes, those earning less than £19,000 will actually be worse off.

Susannah Streeter, head of money and markets, Hargreaves Lansdown

ISAs are a popular product which helps get people investing for the first time, its vital that we keep this framework simple.

We welcome the launch of the consultation which considers how to revitalise UK listings with a British ISA. We have heard the calls around improving liquidity in London markets, especially at the small and mid-cap end. Here retail investors have an important role to play. HL’s clients are already enthusiastic UK investors with 83% of shares held in UK listings. With over 1000 UK equities available on our platform there is plenty of choice. In our response to the consultation, we will explore how best to support these investments.

Beyond this it’s clear that we need measures to encourage more people with excess cash savings to invest. Here there are other levers to pull. The review of the advice boundary allowing for more personalised support for consumers has the potential to have a significant impact. Helping the 92% who do not receive investment advice, make their first steps into investing.

James Enos, national account manager, Hodge

There are so many factors impacting the ever-evolving holiday let market, and now the Chancellor has reacted further by abolishing business rate relief on furnished lettings for holiday homes in his latest budget statement.

This is a decision that is clearly set to reverberate across the market for some time to come, and one which could potentially put off some investors who had identified holiday lets as a buy to let alternative due to the attractive yields available.

Then again, the flexible criteria being made available by increasing numbers of holiday let lenders at present could come as a handy antidote to this, and we still haven’t yet seen an impact in consumer appetite for staycations in general, so it’ll be interesting to see how this affects the UK holiday let market in the coming years too.

High inflation and the ongoing cost of living challenges will all have some kind of knock-on effect eventually, but looking at our back book and the profile of holiday let investors working with us, we would still assume any impacts will be limited in the short term at least.

Douglas Grant, group CEO, Manx Financial Group

Today’s decision to provide £200M of funding to extend the recovery loan scheme, enabling 11,000 small and medium-sized enterprises (SMEs) access to the finance they need, brings hope and encouragement to both businesses and consumers. SMEs should take this opportunity to reevaluate their current lending arrangements and strengthen their positions.

Research conducted by Manx Financial Group reveals a significant shift in the financial landscape for SMEs. In contrast to the previous survey, where only 25% faced challenges, the current findings indicate that two out of five SMEs are now grappling with operational slowdowns or halts due to a lack of external financing. The survey also underscores that 15% of SMEs seeking external finance or capital are unable to secure the necessary funds. This financial constraint, coupled with a potentially unprecedented and volatile environment marked by ongoing conflicts, multiple elections, a tightening labour market, and persistent cost-of-living challenges, poses obstacles to the prospects of SMEs and national economic growth. Moreover, given the projection of stubbornly high interest rates for the next 12 months and increasing demand for working capital, we encourage SMEs to reassess their current lending situations. It is crucial for them to be well-prepared but mindful of potentially reducing debt payments this year.

We have been calling for the current and next government and Treasury to remain focussed on short-term loan schemes. We also believe that prioritising the establishment of a permanent government-backed loan scheme, tailored to resilient sectors and involving both traditional and non-traditional lenders, could be instrumental. Such a permanent scheme has the potential to play a pivotal role in unlocking economic resurgence for numerous companies, thereby sustaining the overall economy—especially as this year’s UK business performance looks shaky.

Paresh Raja, CEO, Market Financial Solutions

In his attempts to woo voters before the upcoming election, the Chancellor missed a trick by not bringing forward more meaningful, positive policies for the property market. But we knew that was likely to be the case.

Cutting property CGT rates will be welcomed in some quarters. But elsewhere, after years of tightening regulation in the buy-to-let market, the Government has indeed now moved to put the squeeze on holiday lets. Ensuring there are ample properties available for local homebuyers in tourist hotspots makes sense, but it is regrettable that the solution is always to target investors and penalise landlords rather than boosting supply through greater investment into housebuilding.

We also have to be alert to the fact that scrapping non-dom tax rules risks damaging the appeal of the prime London property market among international investors. Time will tell how plans for a shorter-term non-dom-style tax status might take shape, but given Labour was already pushing to scap non-dom status, we should not expect much relaxation in this reform.

That there was so little by way of stamp duty reforms, housebuilding commitments or ways of incentivising landlords to invest in their properties – particularly for energy efficiency purposes – was disappointing. It was telling that Hunt praised the Government for having overseen the building of 1 million new homes in this parliament, even though this figure falls well short of what is needed in a five-year period. Meanwhile, suggestions of new 99% mortgages did not come to fruition.

Ultimately, after two years of rising interest rates, today’s Budget would have been an opportune moment to bring about a string of policies and reforms to boost the property market. It feels like a missed opportunity.

Laurent Descout, co-founder and CEO, Neo

The UK government must continue to invest in our high-growth sectors, support start-ups and ensure they have the access to finance which they need to grow and meet demand. One way of doing so would be to bring capital expenditure within the scope of R&D, similarly to Ireland and France, this would help encourage businesses to base their long-term investments in the UK.

Cara Spinks, Head of Insurance Consulting, OAC

The OBR expects revenue from Insurance Premium Tax to rise even higher than expected over the coming years compared to just four months ago, increasing its forecasted revenues by more than £370m between 2023-24 and 2028-29.

We are disappointed that the Chancellor failed to take advantage of the Spring Statement to announce a reduction in IPT for health insurance products such as private medical insurance and health cash plans which could have helped make these products more affordable for consumers.

A strategic reduction in IPT on health insurance could encourage a greater take up of the independent health sector, easing pressure on the NHS and reducing workplace inactivity due to long-term illness, which rose by 200,000 in 2023.

Richard Newman, Corporate Affairs Director, Open Banking Limited

OBL welcomes the government’s continued commitment to developing new smart data schemes in the Chancellor’s Spring Budget, accelerating the economic benefits of open banking to the key sectors of energy and transport.

We look forward to seeing the Data Protection and Digital Information Bill continue its progress through Parliament, giving the government formal powers to mandate participation in future smart data schemes. These, together with industry-led initiatives, will allow us to build on open banking’s success and develop new innovative propositions that will benefit consumers and business alike.

Sarwar Khawaja FRSA, chairman, executive board, Oxford Business College

Businesses and workers alike are under the cosh like never before, and everyone was hoping that Jeremy Hunt had enough leeway for a populist Budget giveaway.

While a 2% reduction in national insurance is not to be sniffed at, it feels like second prize for companies who were hoping that a change to income tax might help stimulate the economy.

The cost-of-living crisis has hit people hard, and a drop in consumer spending is creating challenges for the retail and hospitality sectors.

Another 12 months of frozen alcohol duty and extending the 5p fuel tax cut will be good news for consumers, but they won’t improve households’ current situations.

With an election around the corner, it’s not clear that the Chancellor has done enough to reignite the stagnant economy.

Increasing the VAT registration threshold to £90,000 will be welcome news to small businesses and tradespeople, but many will wish that the move went even further.

Scrapping ‘non-dom’ status for foreign nationals might sound like a popular move, but some analysis suggests that it could end up costing the country more in the long run.

Compared with what the government might have hoped to give away a few months ago, this will surely go down as the Wet Blanket Budget.

Jason Whyte, finance expert, PA Consulting

One of the Chancellor’s major concerns is securing greater investment in UK companies and UK infrastructure projects. This is more than just flag-waving.The UK’s Defined Benefit pension schemes have historically been major investors in the UK, and willing to give up liquidity for steady income that aligns well to the payments they make to their annuitants. But these schemes are closed to new members and will gradually shrink over time, while the Government still needs new sources of infrastructure investment. Both the Autumn Statement and the Budget aimed to draw more investment towards UK-based companies and projects – which not only reflects how much importance the Chancellor places on it, but also that the pensions industry is not fully on board. While several companies signed up to the Mansion House Compact, others responded that their hands were tied by regulation.

New reporting proposals will keep the focus on both Local Government and private sector pensions

The Local Government Pension Schemes will be required to report on their asset allocation – including UK investments – and their progress on pooling assets. In turn, private sector Defined Contribution schemes will be required to provide reporting on their value for money relative to two large peers and to report on both their returns and their UK investments. While no immediate action is planned, the reporting will give the Government a clearer picture of how different pensions companies invest. That will give it some ammunition both to pressure those with lower levels of UK investment to keep up with their peers, or to amend the regulations if necessary.

New products to encourage retail investment in the UK, and an echo of 1980s privatisation

Two new products aimed at retail investors were announced – a fixed interest British Savings Bond from National Savings & Investments, and an additional £5,000 ISA allowance for investment in UK-based companies. It is unclear what the appetite for these will be. Historically, the public’s most enthusiastic response has been reserved for products that help them achieve their goals, such as the Help To Buy ISA and Lifetime ISA. One of the stocks that the Chancellor will be hoping investors put in their new UK ISAs will be NatWest, with the Government intending to make a retail share offer as part of a plan to fully exit its remaining shareholding this summer.

Pensions Lifetime Provider remains a goal – or is it a pipedream?

The Chancellor reconfirmed the Government’s continued investigation of whether a Pensions Lifetime Provider is feasible. The ability to carry a pension from one employer to the next has been successful in Australia’s more consolidated market. Yet for the UK – where there are already over 12 million deferred small pension pots – the Small Pots Working Group felt that making consolidation easier was a higher priority than a lifetime provider. Experience in Norway, which allows both portable pensions and consolidation, shows that building the systems to make it possible can be fiendishly complicated.

Will PISCES lure the next generation of big fish into the UK’s pond?

One of the more intriguing provisions in the Budget is the consultation on PISCES – the Private Intermittent Securities and Capital Exchange System. The proposal is that there should be a platform enabling private companies to raise capital through a platform which will allow them to conduct intermittent capital raising, without having to go to a full stock market listing. The hope is that the flexibility of the platform will draw high growth startups to raise capital in the UK and encourage them to stay until they IPO on one of the more senior markets. But to hook the big prizes, PISCES will need to offer compelling access to professional and institutional investors with a fit-for-purpose compliance regime.

Simon Harrington, Head of Public Affairs, PIMFA

While we strongly believe in the principle that retail investors can and should be encouraged to play a positive role in supporting UK businesses with private capital, it is not immediately clear to us that the British ISA represents anything more than a policy announcement in search of a headline.

We see very little appetite to offer such a wrapper while the operational burden, which this would place on firms suggests that even if appetite were there it seems unlikely that firms would want to offer it.

If the Government is really committed to reviving retail investment in UK PLC we would suggest simpler measures like a reduction or abolition of Stamp Duty on share purchases rather than the introduction of yet another ISA into the market.

Jack Fletcher, head of policy & government relations (digital currencies), R3

While it is encouraging to hear the Chancellor announce further measures to boost economic growth, I would have liked to hear more about plans to encourage innovation in the UK’s financial sector.

The introduction of specific regulatory measures to guide the development of innovative tools, like distributed ledger technology, will help to distinguish the UK as a leader in initiatives such as accelerated settlement and central bank digital currencies.

The UK has made good progress with its plans for a digital pound, but choosing the right technology will be the key to its success. The government must prioritise privacy and smart regulation to realise the potential of a digital pound.

It’s simple – for London to retain its status as a global hub for financial services and collaborate on building more connected global financial markets, technology must be at the heart of its strategy.

Andy Butcher, Branch Principal & Chartered Financial Planner, Raymond James Investment Services

The new British ISA announced in the Budget today will significantly improve the attractiveness of British companies at a time when investors have fallen out of love with our markets. Driving up domestic companies’ share prices will encourage overseas investors to re-focus on the UK and reinvigorate local financial markets. Rising markets help attract companies to list in the UK, providing a boost to the City of London. It also helps UK investors, as many of their invested assets in pension funds are listed in the UK.

Ensuring child benefit thresholds are fit for 2024

In today’s Budget, Jeremy Hunt increased the high-income child benefit charge threshold to £60,000. With persistently high inflation, the child benefit tapering freeze has hit home for many. More and more Brits have been caught by the £50,000 threshold for child benefit tapering. From April 2024, 170,000 families will be newly exempt from paying this tax.

Cut to Capital Gains Tax (CGT)

Reducing the rate of CGT on residential property disposals could help compensate for lack of action on inheritance tax. Many are put off selling or gifting their investment properties by high tax rates on gains, so this may help not only increase tax take for the Government, but also help homeowners pass wealth onto the next generations.

Antony Antoniou, CEO, Robert Irving Burns (RIB)

Non-domiciled UK residents face decisions about what to do now that the non-domiciled tax status is set to end in April 2025. What those nearly 70,000 non-doms decide could have wide repercussions for the UK’s tax revenue and international competitiveness.

It is not only super-rich business owners and heirs that benefit from the status, non-doms also include City of London bankers, lawyers and consultants. Those living off unearned income are far outnumbered by non-doms who work.

Gianpaolo Mantini, chartered financial planner, Saltus

Rumours around Jeremy Hunt announcing a tax-free ‘British ISA’ have been resurfacing, and whilst any measures that encourage increased savings and investment by the British public should be welcomed, it is critical that the Government considers any unintended consequences.

If the current stocks and shares ISA regime was reformed to apply solely to UK companies this would have a detrimental impact on investors. A balanced and diversified approach is always the starting point of any investment strategy, and limiting how the ISA allowance can be used – be that geographically or otherwise – runs contrary to that basic principle and could pose some significant negative impact on long-term savings.

If the Government is considering a wholly new ISA, with an increased overall limit or separate pot that would only apply to investment into UK companies, then this has merit. It would enable investors to continue a diversified approach while at the same time increase incentives to add to their overall annual investment in a way that benefits British companies. It would be interesting to see how this interacts with existing incentives such as EIS and VCTs.

While speculation remains around the prospect of the Chancellor announcing the abolishment of IHT, the most likely change we could see – if any – would be to cut the threshold in which this is applied. Whilst IHT is an emotive tax topic for many, its arguable that it shouldn’t be in the top list of priorities for this Budget.

Andy Mielczarek, founder and CEO, SmartSave

Cutting NI will be celebrated, but we cannot escape the limited effect it will have. Someone on a salary of £30,000 will only get an extra £348 in their pocket annually thanks to the change, which will do little to reverse the impact of rampaging energy bills, food prices and living costs over the past two years.

We should not be overly critical; the Chancellor does not have a bottomless pot of funds to allow for huge sweeping tax cuts. Instead, though, it would have been good to see a greater focus on policies and reforms that could empower people to effectively save, invest, and achieve their financial goals.

Steps need to be taken to simplify and incentivise savings. There is also a pressing need for better education and support when it comes to financial planning, helping people to better assess the wide variety of savings products and providers available to them. Tax cuts need to be bolstered by greater investment into schemes that protect and serve consumers as they make financial decisions.

Andrew Martin, founder, SMEB

SMEs account for three-fifths of the employment and around half of turnover in the UK private sector, which is why it is so important the budget included key commitments to help SMEs continue to invest and grow.

The VAT registration threshold will increase in April from £85,000 to £90,000 meaning that tens of thousands of businesses will not pay VAT, aiding SMEs under the threshold by reducing their financial and administrative costs and enabling them to grow. This is the first increase in seven years, thus the £5,000 increase is beneficial, but it does not fully offset this.

We know that it is challenging for SMEs to access capital, which is why we welcome the announcement of the extension of the recovery loan scheme (changing to the growth guarantee scheme) and the addition of £200. This will crucially help 11,000 SMEs access the finance they need to invest and expand.

The extension of the freeze on alcohol duties until February 2025, will benefit the 38,000 pubs, many of whom are SMEs.

While we welcome the government’s support, critical areas remained unaddressed. There is great concern about access to banking services – which is not filled by the government’s Access to Cash programme. Private industry will need to plug the gaps left by today’s actions.

Hetal Mehta, head of economic research, St. James’s Place

With all the headline grabbers already rumoured, there was little unexpected in today’s announcements – this is no doubt a welcome sigh of relief from the gilt market.

Taxes are down, with a focus on workers. But that won’t prevent the tax burden from rising to the highest it has been since the late 1940s. The remaining fiscal wriggle room is now even smaller than it was back in November, which gives little scope for the OBR’s relatively upbeat forecasts to disappoint. We could still see one more fiscal event if the election is in the Autumn, but the room for more giveaways seems slim.

Claire Trott, divisional director of retirement and holistic Planning, St. James’s Place

We welcome all opportunities for tax free investment with the ‘British ISA’ increasing the overall ISA allowance. However, it comes with restrictions on where you can invest which may be a turn off for some. It also adds to the complexity of something that used to be simple, we now have multiple ISAs with various restrictions, which will probably mean more need for financial advice.

Eliana Sydes, head of financial life strategy, Y TREE

Whilst the decision to scrap the ‘non-dom’ tax status will push some to leave the country, it is unlikely to have a material impact on the vast majority of affected individuals and will ultimately help simplify our tax code.

In our experience, we find people rarely base decisions about where they live solely on tax efficiencies. Rather than zeroing in on tax savings, these individuals will choose to base themselves where they can get the best lifestyle for themselves and their families – whether that’s access to good education, being near friends and family or simply because of language barriers. For those who do not rely on the ‘non-dom’ tax break to maintain their lifestyle and any long-term goals, remaining in the UK is worth more than any potential savings.