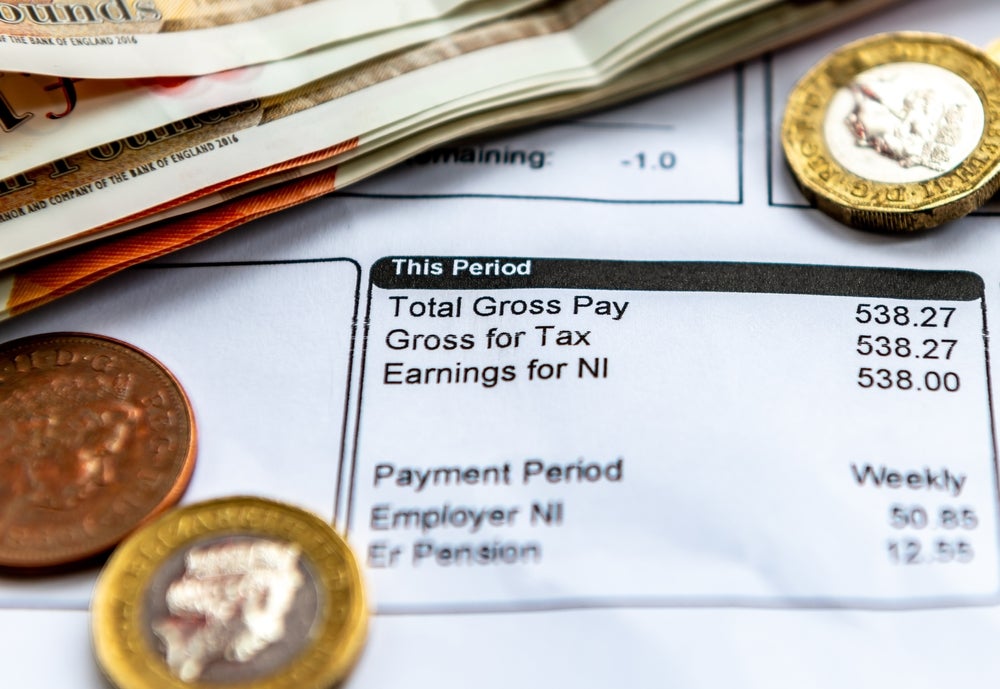

Employers paid out a record £105bn ($129bn) in National Insurance bills in the year to September 20 2023, a figure that has risen by more than £7bn from £97bn in 2021/22 says national accountancy group UHY Hacker Young.

UHY Hacker Young partner, Nick Donohue, said: “Employers are being hit twice over – once by wage inflation and once by the jump in National Insurance bills that has caused.”

“The Chancellor should look at cutting Employers’ National Insurance in the Autumn Statement. The number of companies being forced into insolvency is at its highest level since the last financial crisis and there needs to be some respite.”

“Many people see National Insurance as a tax on employment. At a time of huge economic uncertainty, a cut in National Insurance would protect jobs and businesses.”

Donohue added that sectors such as hospitality have been hit particularly hard by the large rise in the minimum wage in April this year (which also increases employers’ NI bills), combined with the effects of falling consumer spending.

The 10% rise in the minimum wage to £10.42 earlier this year was the biggest single increase since the minimum wage was introduced in 1999.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDonohue concluded: “Running a restaurant or pub has become far more challenging this year due to the jump in the minimum wage. That rise has had a significant impact on National Insurance bills and cut margins to the bone for many.”