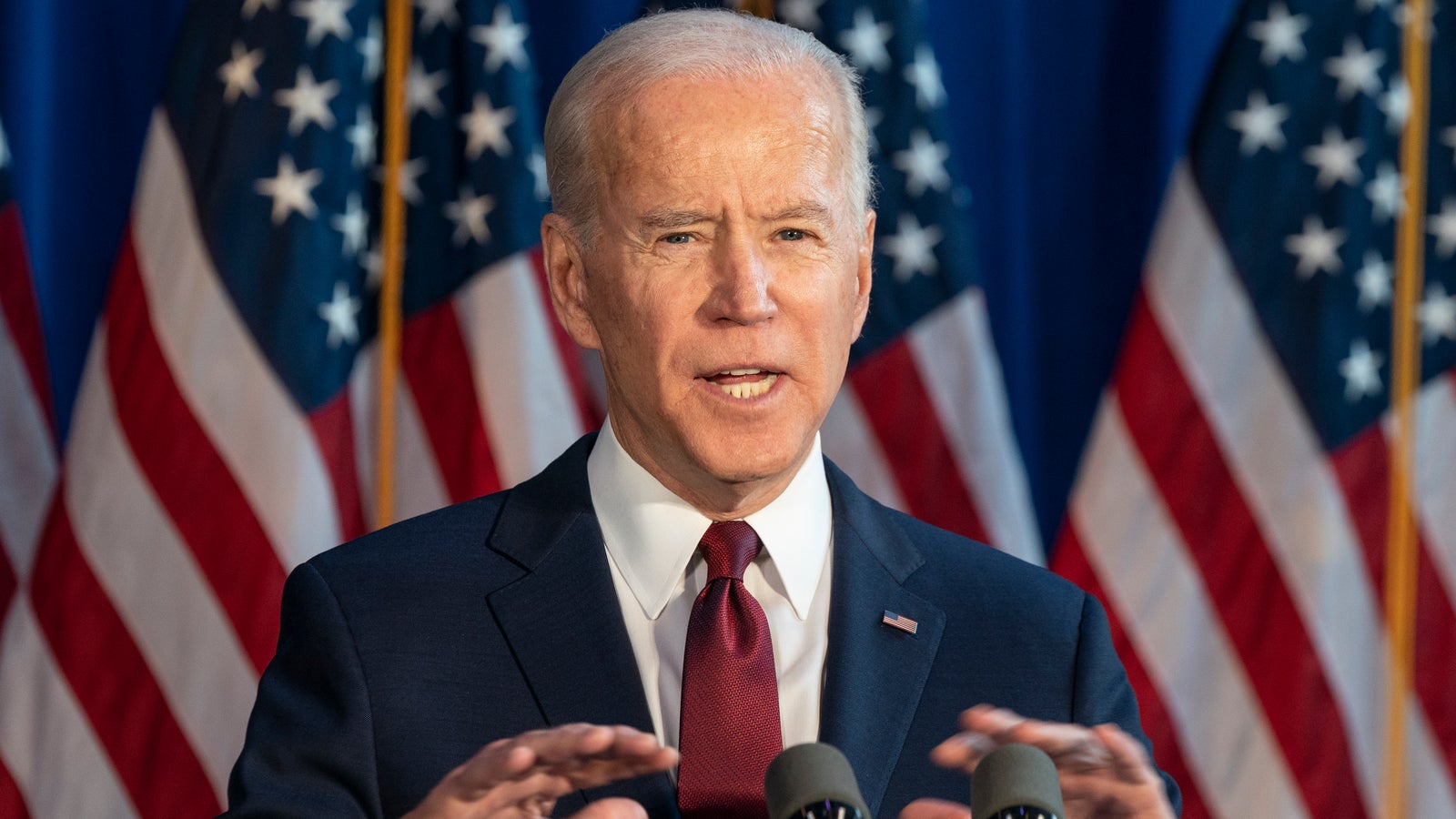

Industry experts comment on President Biden’s proposals for global tax reforms to limit the ability of multinational corporations to shift profits overseas (BEPS) and the setting up of worldwide minimum tax rates.

Ramon Camacho, Principal, RSM US LLP

Biden’s Global Tax Plan: Accounting Firms Are Reacting

“The Biden administration’s latest proposals mark a significant change in direction for the US, and for the international tax landscape. For the last 20 years, we have seen countries around the world lower their corporate taxes to encourage economic activity. However, as the pandemic begins to come to an end, the role of government is changing in many nations. There is a growing consensus that governments have greater social responsibilities, and funding these priorities becomes paramount.

“There are other advantages for the US as well. With countries introducing digital services taxes to target the revenues of large digital companies (primarily American) that have grown during the pandemic, the Biden administration has been faced with the question of how to respond. While tariffs might present a short-term solution, a standardised corporate tax rate would reduce instances of profit shifting, and see those revenues collected in the US rather than abroad.

“In terms of how these changes might affect how we advise clients, it is still early in the process. Biden’s proposals are ambitious, and would affect a wide variety of taxpayers, large and small, that have multinational operations. If passed, Biden’s proposals would impose significant change even as taxpayers are still adjusting to the enormous reforms to the international tax system enacted as part of the Tax Cuts and Jobs Act in 2017, and so taxpayers may view Biden’s proposals as an onerous challenge to implement.

“In the US, we work with clients to model the impact of these possible changes and help them chart possible responses, which range from restructurings to enhancing their compliance systems. In any event, after years of developing more rigorous information reporting rules and entering into cross-border information sharing agreements, tax authorities are getting better at collecting and sharing data. As a result, we expect enhanced enforcement around the world as countries look for revenue to fund their national agendas. To prepare for this ‘new normal’, we are helping businesses of all sizes improve the way they store and report their data, including by digitizing their financial data in order to enhance compliance and identify opportunities.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGuillermo Narvaez, tax expert at Kreston International, commented:

“It catches my attention that Ms Yellen is looking to defend the world, not only the US, and it looks as if the Biden administration is putting significant effort into differentiating itself from Trump’s government, which primarily concerned itself with ‘making America great again.’

“President Biden looks to have quite a different position, whereby he is concerned about the welfare of other countries. Indeed, as Ms Yellen says, ‘it is about making sure that governments have stable tax systems that raise sufficient revenue to invest in essential public goods and respond to crises, and that all citizens fairly share the burden of financing government.’

“As far as I know, one of the main supporters of overhauling the international tax framework was President Obama. The tax reform proposed during his time in office shares many aspects directly related to the BEPS plan.

“Now, President Biden has continued this aim of working with the OECD with respect to harmful tax policies and shifting profits where no or little tax is paid. It’s interesting to see that the new administration in the US is coming back to the same path as when Mr Biden acted as Vice-President.

“This initiative proposed by President Biden is exactly double that of the GILTI rate, an offshore minimum tax that President Trump introduced. GILTI is 10.5%, whilst the new proposal is to tax the large multinationals with a global minimum tax of 21%.

“In 2020, the OECD corporate tax rate average was 21.5% and the one applied in the US is 21%, meaning that a global minimum tax of 21% would be effective even in jurisdictions with low corporate income tax rates. We will, however, see what Ireland has to say about this new proposal.

“There is no evidence that countries with a DST (Digital Services Tax) will derogate the domestic digital taxes already in force if either of the OECD’s Pillars One & Two or the multinational minimum tax now proposed by the US comes into effect. However, it is a fact that G20 countries are jointly analysing the US minimum tax plan, and thus it makes sense for there to be a consensus across all countries in the Inclusive Framework, working to eliminate DSTs and face the digital economy challenge with one united strategy worldwide.”

Steve Heathcote, CEO, PrimeGlobal comments:

It is important to understand the context. President Trumps change to the tax code a few years ago were significant reducing the corporation tax rate from 35% to 21% in the US. This was a territorial approach designed to favour investment in the US. However, the changes blocked global agreement regarding corporate taxation levels which could prevent profit transfer to reduce tax. Since then some countries have acted independently introducing digital tax on tech giants. President Biden now has two main aims with his tax changes – to incentivise innovation investment in the US and disincentivize profit transfer to lower tax jurisdictions. This is required to fund his infrastructure plan to help the nation recover from the pandemic. To find out more, I discussed Biden’s proposal with Mary D. Richter, Schneider Downs (Chair of PrimeGlobal’s International Tax Group) and Dan Phillip, Schneider Downs (technical group Head). Richter commented:

‘’This is very much the opening gambit to start a negotiation. It is going to very challenging for the President to obtain the necessary support from Congress. So at this stage, I would not advice clients to take action. It is too early to determine what the final changes will be. It is the unintended consequences that are particularly difficult to predict. On the surface, the proposal could be seen as simplifying tax globally by eliminating difference and only impacting the largest companies. In practice, however, we have seen that such changes can adversely impact companies that may have limited foreign activities who have no desire to avoid tax. The legislative landscape is so complex that any change is likely to impact many mid-sized companies. They therefore need to stay alert and we will be ready to advise them regarding the consequences of change.”

Phillip added, “It is important for companies to review their arrangements to ensure that they can be flexible and nimble to respond to change. If there structures are too locked down they may find that they are adversely impacted by the tax changes. Now is the time to consider scenarios and obtain advise to ensure that they are ready to do business in an agile way.’’

PrimeGlobal firms are ready to work together to support their clients with taxation advice to enable global trade that increases global prosperity. It is important for policy makers to consider the wider needs of mid-size companies which will be the foundation for economic growth and innovation.