Design a Cash Flow Forecasting Model

Corporate treasury departments rely heavily on cash flow forecasts. Cash forecasts are vital for ensuring that a company has enough cash in its reserves to cover any required outgoings. The forecast also supports key strategic decisions, from M&A to investment planning. As such, companies are increasingly looking to improve, or completely rebuild, their cash forecasting processes.

One of the first steps in setting up a new cash flow forecasting process is designing a forecasting model.

If the forecasting model is well-designed from the outset it can drastically improve the quality of reporting outputs, thereby helping to achieve overall business objectives. However, it must be noted that there is not a universal solution. Well-designed, is this instance, means perfectly tailored to the precise business objectives identified at the outset.

Below is a high-level view of the key steps that can be taken to ensure this stage of the cash forecasting process is built well and fit-for-purpose.

Design the model outline upfront

A forecasting model is the reporting structure and associated logic that produces the required forecast output. A forecast model has two dimensions and typically collects two types of cash flow data.

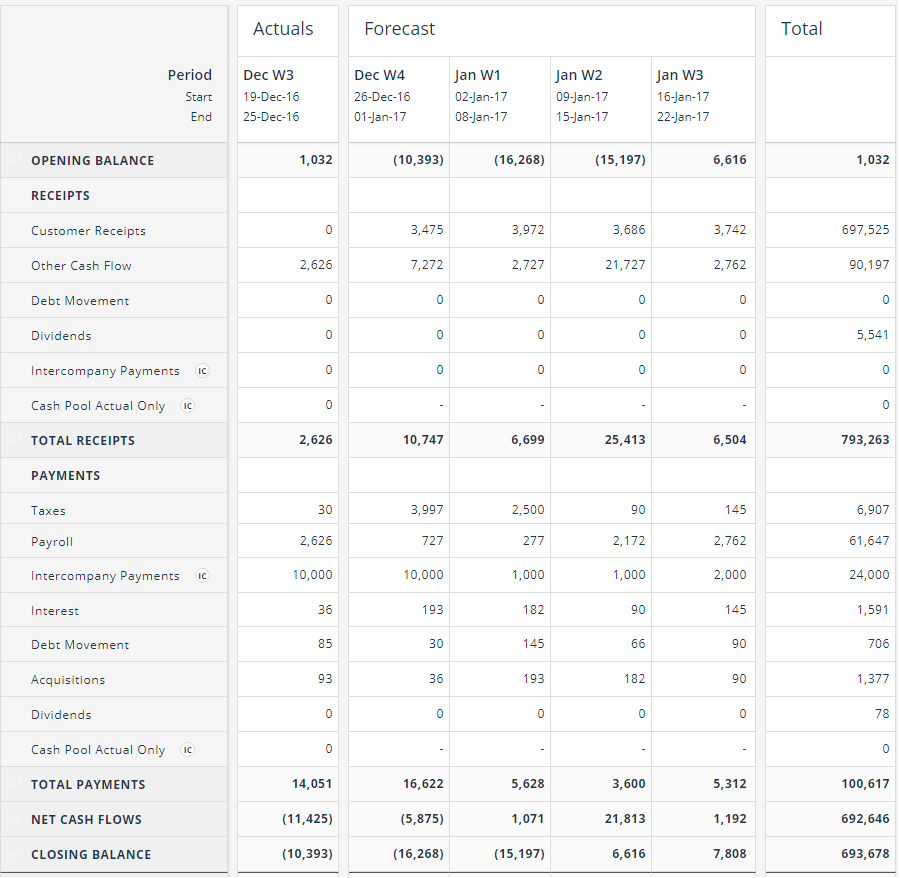

The image below is a simplified version of a typical forecasting model:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

The two dimensions of a forecasting model are:

1. Reporting periods – these might be daily, weekly, or monthly depending on the forecasting horizon and granularity.

2. Cashflow classifications – these typically group cash flows to a “management reporting” level of detail. Depending on the needs of the business these could be more granular, e.g. receipts could be categorised at a customer level.

The two types of cash flow data in the model are:

1. Actual data.

2. Forecast data.

Choosing the right granularity and forecast horizon

When choosing the level of granularity for both the reporting periods and cashflow classifications it is important to strike a balance that meets business objectives. This means not getting bogged down in more detail than is needed, while at the same time not taking a view that’s too broad to highlight important data points.

To assist those currently deciding on the appropriate time horizon for their cash forecasting process, CashAnalytics are in the process of releasing a short series of articles which maps objectives to horizons. The first explores the practical applications for the 13-week cash flow forecast, and the second does the same for a daily cash flow forecast.

The table below includes some illustrative business objectives. It suggests which forecast horizon, reporting date granularity, cashflow classifications, and frequency of creation would be suitable for each.

The key point is that the structure of the model chosen must be able produce the range of reporting outputs needed to meet the business objectives.

Including actual data

Actual cash data allows the forecast model to produce both trend and variance analysis which strengthens the process by providing supplementary analysis capabilities to the base forecast.

As was the case with the granularity decisions, choosing how much actual data to include will depend on the business objectives.

About CashAnalytics

CashAnalytics has helped many companies across a broad range of industries to build and maintain best-in-class cash forecasting processes that produce the highest quality reporting and analytics outputs.

Our flagship cash flow forecasting software provides dashboards, status reports and forecasts, where data is presented with an intuitive interface. You can see real-time cash positions from across the entire business while a suite of analytics tools helps uncover insights in your data that improve decision making.

If you would like to see a demonstration of how software and data visualisation can improve your forecasting processes, please contact us directly.